Finding affordable life insurance doesn’t have to be a struggle. In fact, it’s easier than most people think. Furthermore, you can get great coverage at a price that works for your budget. Whether you’re young and just starting out, a parent with kids, or even getting close to retirement, there’s a policy that fits your needs and your wallet.

What Makes Affordable Life Insurance Actually Affordable?

The price of affordable life insurance isn’t just a random number. Instead, insurance companies look at several key things when they set your rates. Knowing these factors, in turn, helps you get better prices. Of course, your age matters a lot. The younger you are when you buy a policy, the less you’ll pay. However, that’s just the start.

Key Factors That Affect Affordable Life Insurance Rates

First, your health is a huge factor when it comes to getting affordable life insurance. Specifically, insurance companies check your medical history, current health, and how you live. For instance, smokers pay way more than non-smokers. Sometimes they pay two or three times more. Additionally, your job matters too. If you work in construction, for example, you’ll pay more than someone who works in an office.

The type of policy you choose also changes everything. Specifically, term life costs much less than whole life or universal life. A healthy 30-year-old might pay just $20-30 monthly for $500,000 in term coverage. For the same coverage in whole life? That could cost ten times more.

How Location Impacts Your Affordable Life Insurance Costs

Surprisingly, where you live affects your rates more than you’d think. States with higher living costs often have different insurance rates. Moreover, some areas have higher death rates due to weather, crime, or healthcare access. As a result, insurance companies factor all this into their prices.

Types of Affordable Life Insurance You Can Buy Today

When you shop for life insurance offers, you’ll find several types available. Each one has its own pros and cons. Therefore, knowing your options helps you pick the right coverage without overspending.

Term Life: The Most Affordable Life Insurance Option

For most people, term life insurance is the most affordable life insurance option. Basically, these policies cover you for a set time. This is usually 10, 20, or 30 years. If you die during the term, your family gets the death benefit. If you outlive it, however, the coverage ends. Many policies do let you renew, though.

Term life works great for specific needs. For example, parents often get 20-year terms to protect kids until they’re grown. Homeowners might get 30-year terms to match their mortgage. As the Insurance Information Institute shows, term life gives you lots of coverage for very little money.

Return of Premium Term Life

This type costs more than regular term life but has a nice feature. Specifically, if you outlive the policy, you get all your money back. Although it costs more upfront, some people like it. They see it as a form of savings plus protection.

Simplified Issue and Guaranteed Policies

Do you have health problems? In that case, these policies might help. You don’t need a medical exam for them. However, they cost more and cover less. They’re not the cheapest option, but they make sure you can get some coverage.

Smart Ways to Get the Most Affordable Life Insurance

Getting great rates takes more than just shopping around. Although, that certainly helps too. Making smart moves can cut your costs a lot while keeping good coverage.

When to Buy Affordable Life Insurance for Best Rates

So, when is the best time to buy? The answer is right now. Generally, rates go up as you age. Waiting just makes it cost more. For instance, a 25-year-old might pay $15 monthly. The same policy at 35? That could be $25. By age 45, it might be $50 or more.

However, timing can matter in other ways. Are you working on your health? Maybe you just quit smoking or lost weight. In that case, waiting six months to a year might get you better rates. Insurance companies want to see that you can stick with healthy habits.

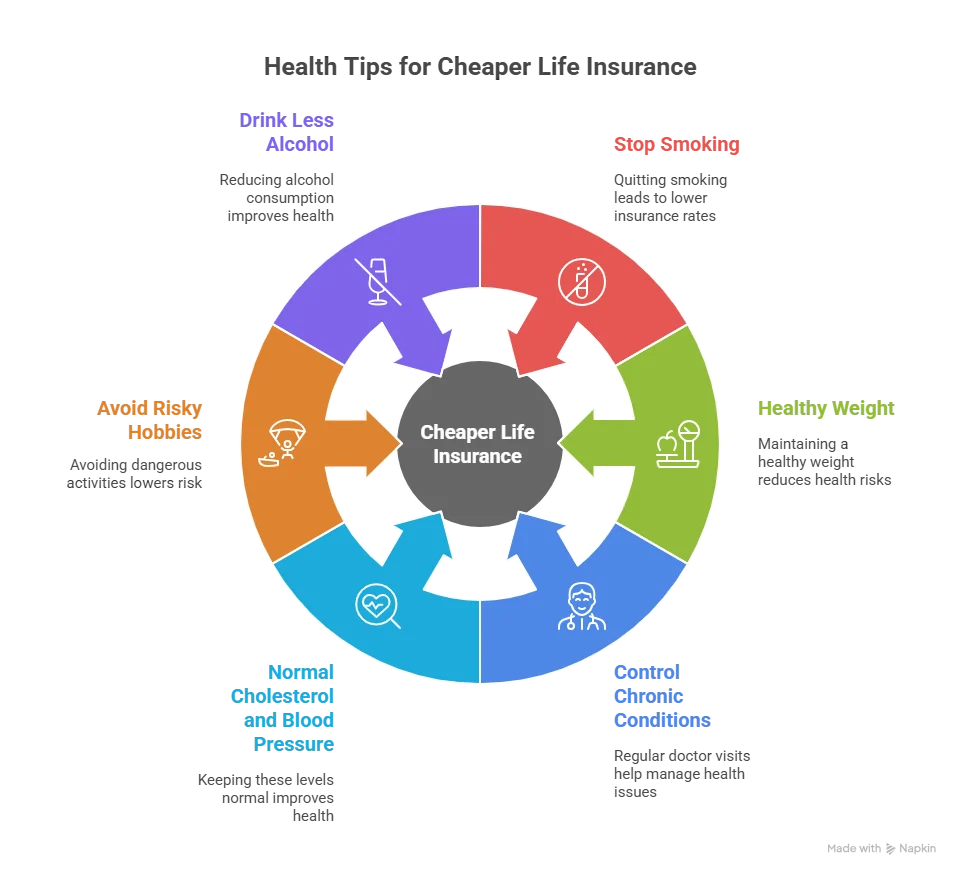

Health Tips That Make Affordable Life Insurance Cheaper

Your health directly affects your insurance rates. Therefore, getting healthier can save you lots of money. Here’s what helps:

- Stop smoking (then wait 12 months for non-smoker rates)

- Keep your weight in a healthy range

- Control chronic conditions with regular doctor visits

- Maintain normal cholesterol and blood pressure

- Skip risky hobbies like skydiving

- Drink less alcohol

Picking the Right Amount of Coverage

Importantly, don’t buy more coverage than you need. That just wastes money. While experts often say get 7-10 times your yearly income, your needs might be different. Think about your debts, your kids’ college costs, and your family’s expenses.

The National Association of Insurance Commissioners has great tools to help you figure out exactly how much you need.

How to Shop for Affordable Life Insurance Quotes

Getting and comparing life insurance quotes is easier now with online tools. However, you need to know how to use them correctly.

Using Online Tools for Affordable Life Insurance Quotes

Most companies have online quote tools. First, you put in basic info. Then, you get quotes fast. Remember, these are just estimates. Your real rate might be different after the underwriting process.

You should have this info ready:

- Your birthday and gender

- Height and weight

- Health status and any medications

- Smoking history

- How much coverage you want

- Your family’s health history

Agents vs. Buying Direct

Independent agents can check multiple companies at once. This saves you time and might find you better rates. Moreover, they know which companies work best for different health situations.

Buying direct from a single company is simpler but also limits your options. Still, some people like this if they already know which company they want.

Mistakes That Make Affordable Life Insurance More Expensive

Even smart shoppers can make mistakes that cost them money. To keep your affordable life insurance truly affordable, you should avoid these problems.

Never Lie on Your Application

Lying to get lower rates is a very bad idea. In fact, insurance companies check everything. They look at medical records, prescription databases, and more. If they catch you lying, you might lose your coverage. Even worse, your family might not get the death benefit when they need it most.

Don’t Auto-Renew Without Shopping

Is your term policy ending? You should not just renew it. Renewal rates are usually much higher. If your health is still good, a brand new policy often costs less. Shopping around could save you hundreds of dollars each year.

Skip Riders You Don’t Need

Riders add extra features but also add to the cost. While some are worth it, others are not. Therefore, think hard about whether you really need each rider.

Affordable Life Insurance at Different Life Stages

Your needs change as your life changes. For instance, what works when you’re 25 won’t work at 45. Let’s look at each stage.

Young Adults Need Affordable Life Insurance Too

Are you in your 20s or early 30s? If so, you’re in the best spot for cheap rates. Even without kids, getting coverage now is a smart move. You can get a long term, maybe 30 years. This lets you lock in those low rates for decades.

Unfortunately, young people often skip insurance. They feel healthy and don’t see the immediate need. However, if you have student loans with co-signers, you need coverage. Also, if you plan to have kids soon, get covered now.

Families and Affordable Life Insurance Needs

Parents need a lot of coverage but also have a lot of expenses. The good news is that term life gives big death benefits for reasonable costs. Many parents even layer policies. For example, maybe a 30-year term for long-term needs plus a 10-year term for extra coverage while kids are small.

Also, don’t forget stay-at-home parents. They might not earn money, but replacing their work costs a lot. Things like childcare, cooking, and cleaning all add up.

Near Retirement? Your Affordable Life Insurance Changes

Are you getting close to retirement? In that case, you might need less coverage. Your house might be paid off. The kids are likely grown. You’ve also saved for retirement. Maybe it’s time to reduce your coverage or let some policies end.

Some people at this stage want permanent insurance for estate planning. While it costs more, it can help with taxes and passing wealth to heirs.

Understanding Group Life Insurance Benefits

Many jobs offer group life insurance. It’s often free or very cheap. However, it has limits you should know about.

Why Work Coverage Helps

Group insurance at work definitely has benefits. For one, no medical exam is needed. Health problems don’t matter. It’s also easy because premiums come from your paycheck.

For people with health issues, this might be their main option for getting any coverage at all.

Why You Still Need More Coverage

Unfortunately, work insurance usually covers just one or two times your salary. That’s not enough for most families. Plus, you lose that coverage if you change jobs.

You should think of work coverage as a start, not the whole answer. Add an individual term life policy to make sure you have enough protection.

The Underwriting Process Explained Simply

Underwriting is the process that sets your final rate. Knowing how it works helps you prepare. It might even help you get better prices.

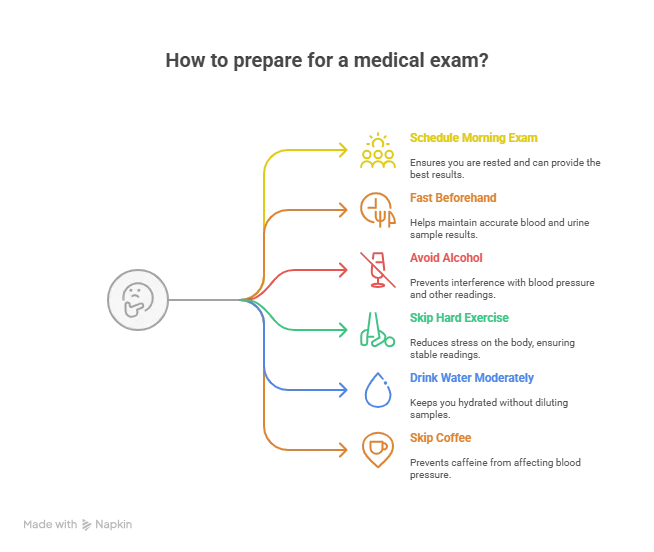

Medical Exams Made Easy

Most policies will need a medical exam. Typically, a nurse comes to you. They will take blood and urine samples. The nurse also checks your height, weight, and blood pressure. Here are some tips for the best results:

- Schedule it for the morning when you’re rested

- Fast for 8-12 hours beforehand if needed

- Avoid alcohol for 24 hours before

- Skip hard exercise the day before your exam

- Drink water but not too much

- Don’t drink coffee that morning

Fast-Track Underwriting

Some companies now approve policies much faster. They use data and digital records instead of an exam. These no-exam policies might cost a bit more or have lower limits. However, they are fast and very easy.

Making Your Affordable Life Insurance Work Better

Once you have coverage, you should manage it well to get the most value from it.

Check Your Policy Every Year

Life changes. Therefore, your insurance should too. You should review your policy every year. Also, check it after big events like a marriage, divorce, new baby, or a big income change. You might need more coverage. On the other hand, you might be able to reduce it and save money.

Try Policy Laddering

Instead of one big policy, you can get several smaller ones with different terms. For instance, you could have a 10-year, 20-year, and 30-year policy. As you need less coverage over time, the shorter policies end. This strategy cuts your costs while keeping the right amount of coverage.

New Technology Making Affordable Life Insurance Better

Technology keeps changing the insurance industry. As a result, this could make affordable life insurance even cheaper and easier to get.

New Insurance Tech

New companies use different ways to set their rates. For example, some use data from your fitness tracker. Others might look at driving habits from your phone. This can mean faster approval and maybe lower rates for healthy people. However, you should think about privacy before sharing your data.

Online-Only Companies

Online insurance companies have less overhead. Specifically, they don’t have agent commissions. This might mean lower prices for you. Just make sure you’re okay doing everything online without an agent’s help.

Common Questions About Affordable Life Insurance

How much coverage do I really need?

Most people need 7-10 times their yearly income. However, your needs are unique. First, add up your debts. Then, factor in living costs, kids’ college, and final expenses. That final number is your coverage need.

Can I get affordable life insurance with health problems?

Yes, but it might cost more. Many people with conditions like diabetes or high blood pressure still get coverage. Different companies treat conditions differently. Therefore, an independent agent can help find the best option for you.

Should single people in their 20s get life insurance?

Absolutely! Rates are super low when you’re young and healthy. You can lock in cheap rates for decades. Plus, if anyone co-signed your loans, you need coverage to protect them.

How much more does whole life cost than term?

Generally, whole life costs 5-15 times more than term for the same death benefit. For example, a 30-year-old might pay $30 monthly for $500,000 in term coverage. For whole life? That could be $300-500 monthly.

How often should I shop for new quotes?

You should check your coverage every year. Then, shop for new policies every 3-5 years. If your health has improved a lot (like you quit smoking or lost weight), shop sooner for better rates.

Can I have more than one policy?

Yes, of course! Many people have multiple policies. For instance, you might have group coverage at work, a personal term life policy, and a small permanent policy. Just make sure your total coverage fits your needs and budget.

What if I can’t afford my premiums?

You have options. With term insurance, you might reduce your coverage amount. Some policies also have waiver riders for disability. You should call your insurer right away if you’re struggling. They might be able to help.

Do rich people need life insurance?

Even wealthy people often need insurance. For example, it provides quick cash for estate taxes. It also helps split an inheritance fairly. In some cases, it can save on taxes. However, if you have enough other assets to cover everything, you might not need it.

Taking Action to Get Affordable Life Insurance Today

Getting affordable life insurance isn’t just about finding cheap rates. Instead, it’s about getting the right coverage to protect your family without hurting your budget. The key is to know your options. Be honest about your needs. Finally, act while you’re young and healthy enough for the best rates.

First, start by figuring out how much coverage you need. Next, use online tools to get life insurance quotes from several companies. If your situation is complex or you have health issues, then work with an independent agent. Most importantly, don’t wait forever to decide. Even basic term coverage protects your family. You can always adjust it later.

The most expensive insurance is always the one you don’t have when your family needs it. So, follow these tips. Avoid the common mistakes. In doing so, you’ll find affordable life insurance that gives you peace of mind without emptying your wallet.

You can check out Consumer Reports’ life insurance guide for more helpful tips.

Ready to protect your family’s future? Don’t wait. You can contact our team for personal help, or call (123) 456-7890 to talk about finding affordable life insurance that works for you.

When it comes to affordable life insurance, the best policy is the one that’s there when your loved ones need it. Therefore, make that smart move today. Your family will thank you for thinking ahead and getting their tomorrow secured at a price that works today.