1. The Pivot: Why You Can't Find Individual Health Plans

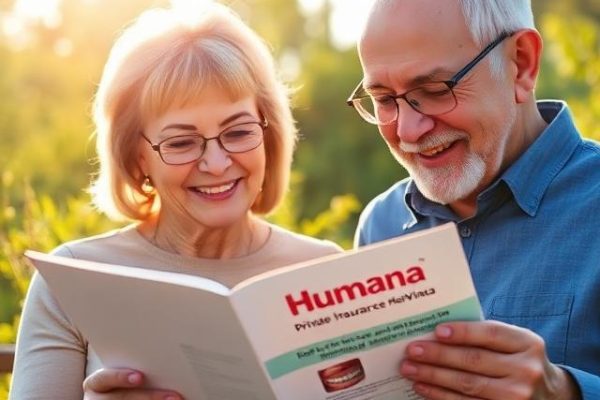

For decades, Humana was a major player in private health insurance for individuals. However, following the volatility of the ACA exchanges, the company made a strategic pivot.

Current Status:

- Individual Medical: Discontinued. You cannot go to HealthCare.gov or a broker and buy a Humana medical plan for a family under age 65.

- Employer Group: Available. If your employer offers benefits, they may use Humana as the carrier. This is the only way for most people under 65 to get Humana medical coverage.

2. Humana's Core Focus: Medicare Advantage (Part C)

When people say “Humana,” they usually mean Medicare. Humana is the second-largest provider of Medicare Advantage plans in the United States.

These are “private” plans that replace Original Medicare (Part A and Part B).

- HMOs and PPOs: They offer managed care networks that often include extra perks not found in government Medicare, like gym memberships (SilverSneakers) and meal delivery after surgery.

- Part D: Humana is also a massive provider of standalone prescription drug plans(PDP).

Intent Check: If you are turning 65, “Humana private insurance” likely refers to these Medicare Advantage plans, which are widely available and highly rated.

3. What You CAN Buy: Standalone Dental and Vision

Humana Dental

One of the most popular private dental carriers.- Loyalty Plus: A unique plan that increases your annual maximum and decreases your deductible the longer you stay enrolled.

- Preventive Value: Basic plans covering exams and cleanings.

Humana Vision

Often underwritten by EyeMed, these plans cover eye exams, frames, and contact lenses. Note: You do not need to be on Medicare to buy these. You can quote and enroll online in minutes.

4. CenterWell: The New Face of Care

You might also see the name CenterWell associated with Humana. This is their healthcare services division.

- CenterWell Home Health (formerly Kindred at Home).

- CenterWell Pharmacy (formerly Humana Pharmacy).

- CenterWell Senior Primary Care.

This vertical integration means Humana doesn’t just pay for your healthcare (insurance); in many cases, they actually provide the care (doctors and clinics).

5. Alternatives if You Need Individual Medical

- Blue Cross Blue Shield: Available in nearly every state.

- UnitedHealthcare: Returned to the exchange market in many areas.

- Aetna (CVS Health): Expanding their ACA footprint aggressively.

- Oscar Health: Tech-focused insurer popular in urban areas.

Frequently Asked Questions

Does Humana sell Obamacare plans?

No. Humana exited the individual ACA (Obamacare) exchange market completely in 2018. They do not sell individual major medical plans.

Is Humana good for Medicare?

Yes. Humana is consistently rated highly for its Medicare Advantage plans. According to [J.D. Power], Humana frequently ranks near the top for member satisfaction in the Medicare Advantage category.

Can I keep Humana if I leave my job?

Only through COBRA. Since Humana does not sell individual plans, you cannot “convert” your employer coverage to a personal Humana plan. You would have to switch to a different carrier on the public marketplace.

Does Humana cover Tricare?

Yes. Humana Military administers the TRICARE East Region contract, providing health coverage for military members and their families in that region.

Is Humana the same as CenterWell?

Yes and no. CenterWell is the brand name for Humana’s healthcare delivery services (clinics, pharmacy, home health). Humana is the brand name for the insurance plans. They are part of the same parent company.

A Medicare & Group Specialist

While the days of buying a “Humana private insurance” plan for your family are over, the company remains a titan in the industry.

- For Seniors: Humana is a top-tier option for Medicare Advantage.

- For Employees: Check your company benefits guide.

- For Everyone Else: Look to Humana only for dental insurance and vision needs, and shop other carriers for your medical coverage.

Take Action

- Need Medical? Visit HealthCare.gov to find available carriers in your zip code.

- Need Dental? You can get a direct Humana dental quote on their website.

- Turning 65? Compare Humana’s Medicare Part C options against competitors like UnitedHealthcare.

Secure your financial future by verifying your flood zone and purchasing flood insurance policy well before storm season begins.

Take Action

- Check your zone: Use the FEMA Flood Map Service Center to see your risk level.

- Start the clock: Remember the 30-day waiting period.

- Compare: Ask your broker to quote both NFIP and private insurance options.