For most people, a home is the largest purchase they will ever make. Consequently, protecting this asset is not just a recommendation; it is often a requirement by mortgage lenders. But beyond the lender’s mandate, a robust insurance policy provides a safety net for your financial future. According to the Insurance Information Institute, homeowners insurance is a package policy, meaning it covers both damage to your property and your legal responsibility for any injuries and property damage you or members of your family cause to other people.

What Does a Standard Policy Actually Cover?

When you purchase a standard policy, often referred to as an HO-3, you are buying protection against specific perils. But what does that mean for your daily life?

- Dwelling Coverage: This pays to repair or rebuild the physical structure of your home if it is damaged by fire, hail, lightning, or other listed disasters. It is vital to ensure your coverage limit is high enough to cover the total cost of rebuilding (construction costs), not just the current market value of the house.

- Personal Property: This extends to your belongings inside the home—furniture, clothes, electronics, and even sports equipment. If your television is stolen during a burglary or your couch is ruined by a burst pipe, this coverage helps replace them.

- Reader Query: “Are my expensive items covered?”

- Secondary Intent: Most policies have limits on high-value items like jewelry, furs, and art. For example, a standard policy might only cover $1,500 for stolen jewelry. To fully protect these assets, you typically need to add a “floater” or “endorsement” to your policy.

Additional Living Expenses (ALE) → reimburse → temporary housing costs.

If a disaster makes your home uninhabitable, ALE pays for the extra costs of living away from home, such as hotel bills, restaurant meals, and other living expenses, while your home is being repaired. For example, if a fire destroys your kitchen and you cannot cook, ALE covers the cost of eating out until the kitchen is restored.

Understanding the Safety Net: Liability Protection

Homeowners insurance is not just about the house; it is about the people inside and around it. Personal liability coverage protects you financially if you or a family member (even a pet) accidentally causes bodily injury or property damage to someone else.

- Scenario: If your dog bites the mail carrier or your child throws a ball through a neighbor’s window, liability coverage steps in. It pays for the injured person’s medical bills and your legal defense fees if you are sued.

- Reader Query: “What if someone gets hurt on my property?”

- Medical Payments to Others: This is a no-fault coverage that pays for medical bills if a guest (not a resident) is injured on your property, regardless of who was at fault. This minor coverage can often prevent small accidents from turning into major lawsuits.

How Much Will You Pay? Decoding the Premium

The cost of your insurance (your premium) is not arbitrary. Studies show that insurers use complex algorithms to determine risk. Several key factors influence your bottom line:

- Location: If you live in an area prone to wildfires, tornadoes, or high crime rates, your premiums will be higher. Proximity to a fire hydrant or a professional fire department can actually lower your rate.

- Credit History: In many states, insurers use credit-based insurance scores to predict the likelihood of filing a claim.

- Deductibles: This is the amount you pay out of pocket before your insurance kicks in. A higher deductible generally lowers your premium, but it means more immediate expense during a claim.

What is NOT Covered? The Exclusions

This is the most common knowledge gap for new homeowners. While you are covered for fire and wind, you are generally not covered for water that rises from the ground (floods) or the ground moving (earthquakes, sinkholes, landslides).

Flood Insurance: This is typically a separate policy backed by the National Flood Insurance Program (NFIP) or private carriers.

Earthquake Insurance: This can be added as an endorsement or purchased as a separate policy.

Reader Query: “Does my policy cover mold or water backups?”

- Secondary Intent: Standard policies often exclude “wear and tear” or neglect. However, you can often add an endorsement for “Water Backup and Sump Pump Overflow,” which covers damage if your sump pump fails during a storm—a vital feature for homes with basements.

How to File a Claim: When Disaster Strikes

In the stressful event of damage, the process can feel overwhelming. However, a smooth claim relies on evidence.

- Mitigate Further Damage: You are required to take reasonable steps to prevent more damage (e.g., putting a tarp over a leaky roof).

- Document Everything: Take photos and videos of the damage before you start cleaning up. Create a home inventory list of damaged items.

- Contact the Adjuster: The insurance company will send an adjuster to inspect the damage. According to consumer advocates, being present during the adjuster’s visit allows you to point out all damage and ask questions about the process.

Frequently Asked Questions

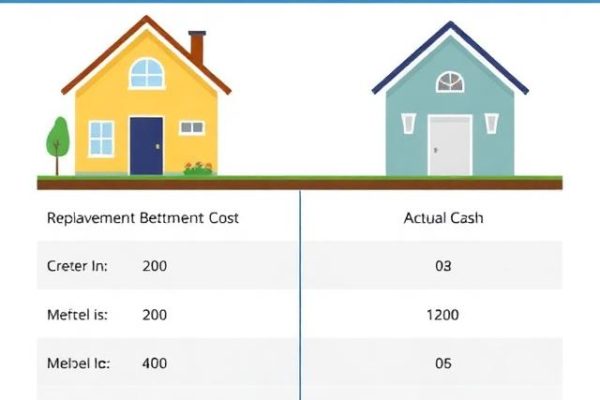

What is the difference between Actual Cash Value and Replacement Cost?

The primary difference lies in how depreciation is calculated. Replacement Cost policies pay for the amount it would take to rebuild your home or buy a new item of similar quality at today’s prices. Actual Cash Value policies pay for what the item is worth today, subtracting for age and wear and tear. While Replacement Cost premiums are higher, they ensure you won’t be left paying out of pocket to upgrade outdated materials.

Why did my mortgage lender require me to get insurance?

Until you pay off your mortgage, the lender technically owns a large portion of your home. They require insurance to ensure that if the house is destroyed (by fire, for example), the asset securing the loan still has value. If you let your policy lapse, the lender has the right to purchase expensive “force-placed insurance” and charge you for it, which is often much more costly than a standard policy you choose yourself.

Can I bundle my home and auto insurance to save money?

Yes, most insurers offer significant discounts if you purchase multiple policies from them. According to industry studies, bundling home and auto insurance can save the average consumer anywhere from 10% to 25% on their combined bills. Additionally, bundling simplifies your finances by giving you a single renewal date and one point of contact for billing.

Will my premium go up if I file a claim?

It depends heavily on the frequency and severity of the claim. A single, small claim for minor damage (like a broken window) might not result in a rate hike, especially if you have a “claim-free” discount forgiveness rider. However, filing multiple claims in a short period or a large liability claim (like a dog bite) almost always signals higher risk to the insurer, resulting in increased premiums or non-renewal at the end of your term.

How often should I review my coverage limits?

You should review your policy at least once a year to ensure your coverage limits match current construction costs and inflation. Furthermore, if you make significant improvements to your home—such as finishing a basement, adding a deck, or remodeling a kitchen—you must update your policy immediately. For example, if you add $50,000 in value to your home but forget to increase your dwelling coverage, you will be underinsured if a total loss occurs.

Final Thoughts

While the paperwork and jargon can be complex, the core purpose of this policy is simple: to ensure that a bad day doesn’t turn into a financial catastrophe. By understanding the relationship between your coverage limits, your deductibles, and the specific exclusions of your policy, you can tailor a plan that truly protects your sanctuary.

- Next Step: Are you paying too much? [Link: Compare Homeowners Insurance Quotes] to see if you can save money while maintaining the same level of coverage.