Providing health insurance is one of the most effective ways to attract and retain top talent, but for small businesses, the cost can be prohibitive. To bridge this gap, the Affordable Care Act (ACA) created the Small Business Health Care Tax Credit. According to the Internal Revenue Service (IRS), this credit is designed specifically to help small employers and tax-exempt organizations afford the coverage they provide for their employees.

Who Qualifies for the Credit?

Not every business automatically qualifies. The IRS has strict criteria regarding the size of your team and how much they earn.

- Employee Count: You must have fewer than 25 full-time equivalent (FTE) employees. Note that this is based on equivalents, not just headcount. Two half-time employees equal one FTE.

- Average Wages: The average annual wages of your employees must be less than a specific threshold (approximately $62,400 for the 2024 tax year, adjusted annually for inflation).

- Contribution Requirements: You must pay at least 50% of the premium cost for employee-only coverage (not including family coverage).

The SHOP Marketplace Requirement

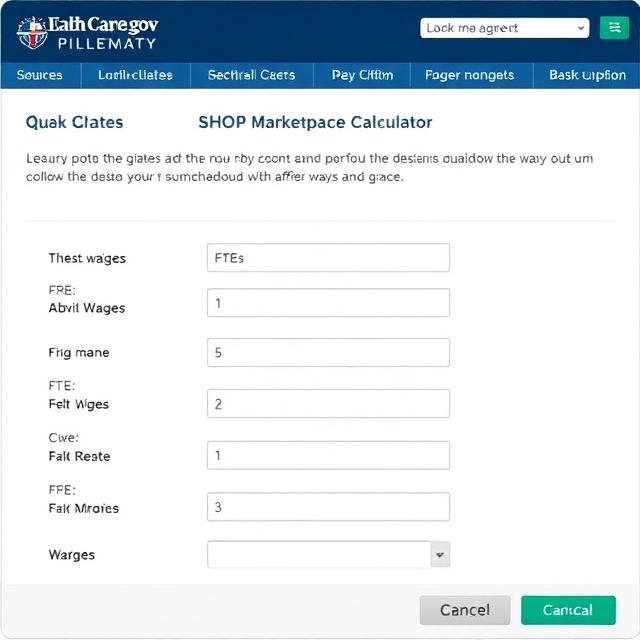

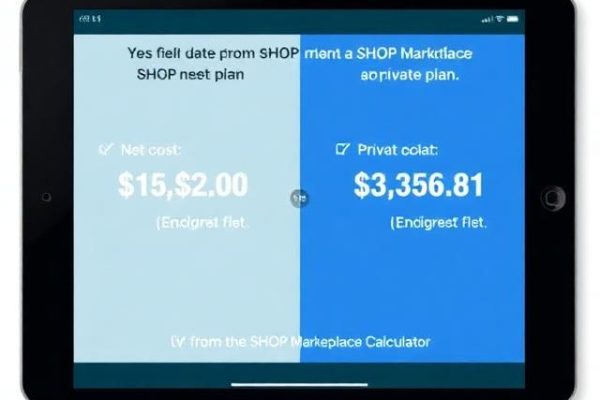

This is the most critical compliance trap for small business owners. Unlike individual health insurance, you cannot buy the plan directly from a private insurance broker or carrier and expect to claim the federal tax credit. According to Healthcare.gov, you must purchase the insurance through the Small Business Health Options Program (SHOP).

The Distinction: The SHOP Marketplace is a dedicated exchange for businesses. It allows you to compare coverage options and prices side-by-side. If you buy a standard group plan outside of this exchange, you are technically ineligible for the tax credit, even if you meet all other requirements.

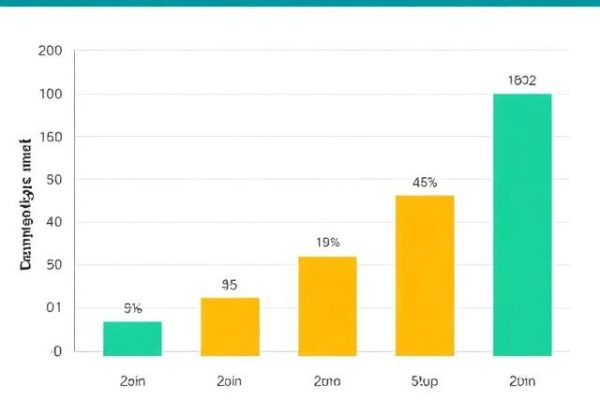

- Maximum Credit (50%): Available only to businesses with fewer than 10 FTEs who are paid an average of $27,000 or less.

- Reduced Credit: As your staff grows closer to 25 FTEs, or as average wages rise toward $61,400, the credit amount phases out.

If you have 24 employees earning $60,000 each, your credit will be very small. If you have 5 employees earning $25,000 each, your credit will be maximized.

Calculating Your Credit Value

The credit value → ranges up to → 50% of premium costs.

The value of the credit is not a flat fee; it is a sliding scale.

Maximum Credit: The maximum credit is 50% of the employer’s premium contributions (35% for tax-exempt employers).

Phase-Out: The credit phases out gradually as the number of employees grows (approaching 25) and as average wages rise (approaching the inflation-adjusted limit). Smaller businesses with lower average wages receive the largest credits. For example, a business with 10 employees earning an average of $30,000 might receive the full 50% credit, while a business with 24 employees earning $58,000 might receive a much smaller percentage.

How to Claim the Credit on Your Taxes

Claiming the credit requires accurate paperwork. You cannot simply subtract the amount from your taxes without documentation.

- Form 8941: For most small businesses, you calculate the credit using IRS Form 8941, “Credit for Small Employer Health Insurance Premiums.”

- Tax Return Integration: You then enter the amount from Form 8941 on the main tax return for your business type:

- Sole Proprietors: Form 1040.

- Corporations: Form 1120.

- S-Corporations: Form 1120S.

- Partnerships: Form 1065.

Because of this limit, some businesses choose to wait to join the SHOP Marketplace until they are financially ready to maximize the credit, rather than “wasting” a year of eligibility when they have very few employees or low premiums.

Frequently Asked Questions

What is the maximum wage limit for the 2024 tax year?

For the 2024 tax year, the average annual wage limit for your full-time equivalent employees is approximately $62,400. If your average wage exceeds this amount, you generally do not qualify for the credit. In previous years, this limit was lower (e.g., $61,000 in 2023), so it is crucial to check the current year’s specific revenue procedure numbers published by the IRS.

Can I claim this credit if I am a self-employed individual?

If you are a sole proprietor with no employees, or if your only employees are yourself and your family, you generally cannot claim the Small Business Health Care Tax Credit. The credit is specifically for employers with staff who are not owners or family members. However, you may still qualify for the self-employed health insurance deduction on your personal tax return.

Does the credit cover coverage for family members?

No, the credit only applies to the premiums you pay for your employees. It does not cover the cost of adding spouses or dependents to the policy. However, paying for family members does not disqualify you from the credit; you just don’t get reimbursed for that specific portion of the expense.

Can I claim this credit for dental and vision insurance?

Yes, dental and vision insurance are considered qualified health coverage under the ACA rules. If you pay at least 50% of the premium for employee-only dental or vision coverage, these costs count toward the credit calculation.

Is it better to take the credit or a general business tax deduction?

A tax credit is almost always more valuable than a tax deduction. A deduction reduces the amount of income subject to tax, whereas a credit reduces the actual tax you owe, dollar-for-dollar. If you qualify for the Small Business Health Care Tax Credit, you should generally claim it, although you cannot use the same premium dollars for both a deduction and a credit. For example, if you claim the credit, you must reduce the amount of health insurance premiums you deduct on your return by the amount of the credit.

Is the Paperwork Worth It?

Navigating the requirements of the Small Business Health Care Tax Credit can be complex, but the financial rewards are significant for those who qualify. By ensuring you have fewer than 25 FTEs, paying at least half of employee premiums, and purchasing through the SHOP Marketplace, you can drastically reduce your overhead while providing a valuable benefit to your team.

- Next Step: Unsure if your current plan qualifies? Use a free group health insurance calculator or consult with a licensed business insurance broker to estimate your potential savings before the next tax year ends.

However, as you grow larger, the benefit diminishes. The key is to calculate your FTEs accurately and ensure you are enrolled in a SHOP Marketplace plan.

Ready to calculate your savings?

- Check Eligibility: Use the official HealthCare.gov Tax Credit Estimator to see if you qualify.

- Get a Quote: Read our guide on Small Business Health Insurance Quotes to compare SHOP plans against private options.