For a Business Owner or Human Resources Director, managing Employee Benefits is a complex exercise in Human Capital Management. It requires balancing Operating Budgets with Talent Acquisition strategies. According to the Society for Human Resource Management (SHRM), health care benefits are consistently ranked as the most important benefit by employees, directly influencing Retention Rates.

At the center of this challenge is the selection of a Group Health Insurance Plan. This decision is not merely a financial line item; it is a fundamental component of Corporate Culture. A well-structured Benefit Package signals that the Employer invests in their workforce. Conversely, data indicates that lack of coverage is a primary driver of Employee Turnover.

Navigating the Health Insurance Market requires decoding a lexicon of acronyms like HMO, PPO, and HDHP, alongside financial terms such as Deductibles and Out-of-Pocket Maximums. This guide utilizes data from the Kaiser Family Foundation (KFF) and IRS regulations to provide a blueprint for Plan Sponsors to align coverage with business goals.

What is Group Health Insurance?

Group Health Insurance is a type of Commercial Health Insurance where a single Master Policy is purchased by an Employer (the Plan Sponsor) and offered to eligible Employees and their Dependents.

The economic principle driving this model is the Law of Large Numbers. By spreading the Financial Risk across a larger population rather than a single individual insurance Carriers can offer lower Insurance Premiums per unit. Risk Pooling creates stability; the larger the pool, the more predictable the Medical Loss Ratio becomes for the insurer.

Eligibility Requirements are strictly governed by state laws and Insurance Underwriting guidelines. Typically, a business must employ at least one Full-Time Equivalent (FTE) who is not the owner or the owner’s spouse. To maintain the health of the Risk Pool, carriers often enforce a Minimum Participation Rate (commonly 70% of eligible staff). This regulation prevents Adverse Selection a market failure scenario where only high-risk individuals with chronic conditions enroll, which would otherwise drive premiums to unsustainable levels.

Small Group vs. Large Group

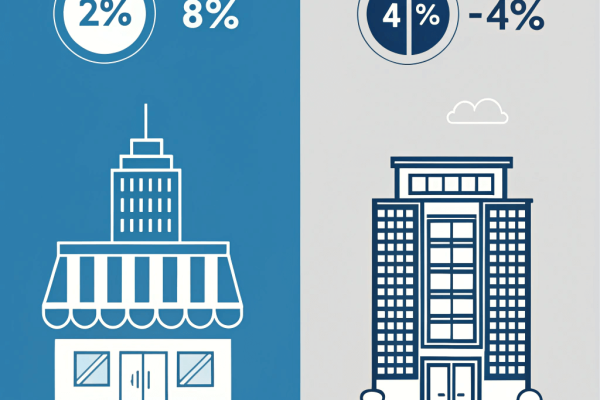

The Affordable Care Act (ACA) bifurcates the market based on company size, affecting how Insurance Rates are calculated.

- Small Group Market (1–50 Employees): As mandated by the ACA, plans in this sector utilize Community Rating. Under this methodology, the Insurance Carrier must charge the same premium to all businesses in a geographic area, regardless of health status. Adjustments are strictly limited to age, geography, tobacco use, and family size.

- Large Group Market (51+ Employees): These plans typically use Experience Rating. Here, the premiums are directly correlated to the specific group’s historical Claims Data. Consequently, a workforce with low Medical Utilization can secure significantly lower rates than the community average.

The Strategic Value Proposition of Group Coverage

Investing in Group Health Coverage generates a substantial Return on Investment (ROI) by enhancing the organization’s Total Rewards Strategy.

1. Optimization of Talent Acquisition and Retention

In the competitive Labor Market, a comprehensive Compensation Package extends beyond Base Salary. A survey by Glassdoor found that nearly 80% of employees would prefer additional benefits over a pay raise. Health Insurance acts as “golden handcuffs,” increasing Employee Loyalty and reducing the disruptions and costs associated with Recruitment.

2. Utilization of Tax Incentives

The Internal Revenue Code (IRC) provides significant fiscal advantages that lower the effective cost of coverage:

- Employer Deductions: Under IRC Section 162, premium contributions paid by the business are 100% tax-deductible as a Business Expense.

- Small Business Health Care Tax Credit: Under IRC Section 45R, small employers (fewer than 25 FTEs with average wages below a specifically indexed cap) may qualify for a tax credit of up to 50% of premiums paid. (Source: IRS.gov)

- Section 125 Plans: Employees typically pay their share of premiums using Pre-Tax Dollars via a Section 125 Cafeteria Plan, lowering their Taxable Income and increasing their Net Pay.

3. Enhancement of Workforce Productivity

According to the Centers for Disease Control and Prevention (CDC), employers who invest in workforce health see savings in Absenteeism and Presenteeism (working while sick). Access to Preventative Care, which is covered at 100% under ACA-compliant plans, helps manage chronic conditions before they become catastrophic claims.

Analyzing Common Health Plan Models

Plan Sponsors must select a model that balances Cost-Sharing with Network Flexibility.

Health Maintenance Organization (HMO)

The HMO model prioritizes cost control through Managed Care.

- Network Structure: Coverage is restricted to an In-Network list of providers.

- Gatekeeper Model: Members must select a Primary Care Physician (PCP).

- Cost Implication: Because HMOs often pay providers via Capitation (a fixed fee per patient), premiums are generally lower than other plan types.

- Target Entity: Best for budget-constrained businesses and employees willing to trade provider choice for lower monthly costs.

Preferred Provider Organization (PPO)

The PPO model emphasizes provider choice and remains the most popular plan type among large employers.

- Network Structure: Members have access to a Preferred Provider Network but may also visit Out-of-Network providers at a higher cost.

- Flexibility: No PCP or referrals are required to see a Specialist.

- Cost Implication: Due to broader access, PPO premiums are typically higher.

- Target Entity: Ideal for workforces demanding autonomy in their healthcare decisions.

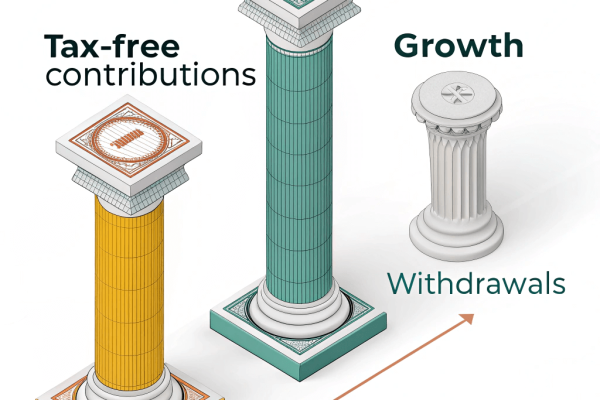

High-Deductible Health Plans (HDHP) & Health Savings Accounts (HSA)

This Consumer-Driven Health Plan (CDHP) pairs coverage with a tax-advantaged financial instrument.

- HDHP Structure: Features lower premiums but a significantly higher Deductible (defined annually by the IRS).

- HSA Entity: A Health Savings Account (HSA) offers a Triple Tax Advantage: Tax-deductible contributions, tax-free growth, and tax-free withdrawals for Qualified Medical Expenses.

- Target Entity: According to Devenir Research, HSA assets continue to grow, making this model ideal for younger, healthier demographics or employers seeking to minimize premium spend while offering a savings vehicle.

Execution: Selecting the Correct Plan Structure

A data-driven approach is required to select the optimal plan.

1. Demographic Analysis: Conduct an internal census. Data shows that an older workforce generally utilizes more medical services, making a PPO or low-deductible plan more attractive, whereas a younger demographic may prefer the savings of an HDHP.

2. Financial Analysis: Evaluate the Total Cost of Ownership.

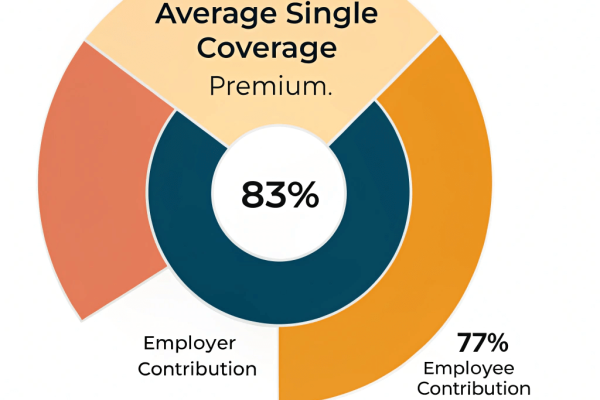

- Premiums: The fixed monthly cost. According to the 2023 KFF Employer Health Benefits Survey, covered workers on average contribute 17% of the premium for single coverage and 29% for family coverage, with the employer subsidizing the rest.

- Out-of-Pocket Maximum: The financial safety net capping the employee’s annual liability, a critical factor for employees with chronic conditions.

3. Regulatory Compliance: Ensure adherence to federal laws.

- Affordable Care Act (ACA): Applicable Large Employers (ALEs) (50+ FTEs) must comply with the Employer Mandate to offer affordable coverage or face 4980H Penalties.

- ERISA (Employee Retirement Income Security Act): Sets minimum standards for voluntarily established health plans in private industry, requiring the distribution of a Summary Plan Description (SPD).

Frequently Asked Questions

What is the minimum participation requirement?

Most states and carriers require at least one W-2 Employee distinct from the business owner. Insurance carriers verify this via quarterly Wage and Tax Statements.

What is Open Enrollment?

The designated period during the Plan Year when employees can enroll or modify coverage. Outside this window, changes are restricted to Qualifying Life Events (QLEs) such as marriage, birth of a child, or loss of other coverage.

How much do employers typically contribute?

While there is no federal minimum for small businesses, the KFF reports that employers typically cover between 50% to 83% of the premium for single coverage to ensure the plan meets “Affordability” standards.

Securing Organizational Health

Selecting a Group Health Insurance Plan is a pivotal intersection of Finance, Human Resources, and Risk Management. It requires navigating the relationships between Carriers, Providers, and Regulations. By leveraging expert guidance from a Licensed Insurance Broker, businesses can secure a plan that ensures Regulatory Compliance, maximizes Tax Advantages, and safeguards the physical and financial health of their most valuable asset: their people.